Ok

Personal Loan Information

Application Cancelled

We have cancelled your application.

If this was a mistake and you would like to fix errors you can return to the application now.

Applicant Information

Monthly Expenses

Important Information about Procedures for Opening a New Account

To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also as to see your driver's license or other identifying documents.

In order to complete the processing of your loan application, you may be asked to provide additional supporting documentation such as Valid Primary Identification, Proof of Income and other supporting documentation such as Proof of Auto Insurance (vehicle loans) or Proof of Homeowner's Insurance (home equity loans).

You may upload supporting documentation here to expediate the processing of your loan application.

Almost Done

Recommendation for best recognition:

* Use a dark background

* Make sure all four corners are visible

* Avoid glare

* Make sure image is in focus

Additional Applicant Information

Monthly Expenses

Important Information about Procedures for Opening a New Account

To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also as to see your driver's license or other identifying documents.

In order to complete the processing of your loan application, you may be asked to provide additional supporting documentation such as Valid Primary Identification, Proof of Income and other supporting documentation such as Proof of Auto Insurance (vehicle loans) or Proof of Homeowner's Insurance (home equity loans).

You may upload supporting documentation here to expediate the processing of your loan application.

Recommendation for best recognition:

* Use a dark background

* Make sure all four corners are visible

* Avoid glare

* Make sure image is in focus

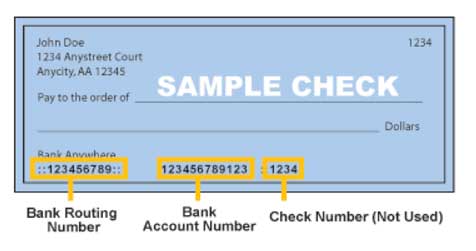

Deposit Account Information

Review and Submit

Because membership is required to take advantage of this wonderful loan product, please tell us how you qualify for membership.

The Membership Share Account is your initial opening deposit here at Inspire FCU. The account serves as your ownership share in the Credit Union, and it is where you keep your $5 membership deposit. Every member at Inspire FCU automatically establishes a Membership Share when becoming a member! Please note: since this is a non-transactional account that only holds your $5 membership share, it will not be viewable in online banking.

APY: 0.05% Min Deposit: $5.00 Max Deposit: $5.00

Manage your money efficiently with no monthly maintenance fees. Add a Round Up Savings & watch your savings grow by rounding up your debit card purchases into your savings account. Receive 100% Round Up match for the first 90 days when you open a new Everyday Checking & Round Up Savings account!

APY: 0.00% Min Deposit: $25.00

Earn 1% cash back on your everyday debit card purchases. Receiving cash back has never been easier – earn up to $25 Cash Back per month on signature-based transactions. $5 monthly fee is waived for accounts receiving a single direct deposit of $250 or more each month.

APY: 0.00% Min Deposit: $25.00

Get a checking account that makes you money with our High Yield checking account. Paying high dividends, our tiered rate structure allows you to earn more as your balance grows. $10 monthly fee is waived for accounts receiving a single direct deposit of $1000 or more each month.

Max APY: 4.07% Min Deposit: $25.00

Even if you have experienced troubled times with your finances, Inspire FCU has the means to help you make a fresh start. $12 monthly fee is waived for accounts receiving a single direct deposit of at least $250 each month or with a minimum balance of $300.

APY: 0.00% Min Deposit: $25.00

Paired with an Everyday Checking, the Round Up Savings is the new way to save your “spare change” by rounding up your debit card transactions to the nearest dollar & placing those funds into your savings account! Minimum $100 must remain in account to avoid $10 monthly service charge.

APY: 0.10%

Earn the highest possible return on your investment, and have access to withdrawal your funds at any time. A tiered interest rate structure pays you more as your balance grows! Premium Purple Savings is perfect for creating an emergency fund or working toward short & medium-range goals when you still need instant access to your cash. Minimum $5,000 must remain in account to avoid $15 monthly service charge.

Max APY: 1.51% Min Deposit: $0.00

We want all of our members to reach their financial goals. That's why we've made it simple to set up secondary savings accounts - so you can save for a specific purpose. Open a Holiday Club to help budget for your holiday expenses!

APY: 0.05%

We want all of our members to reach their financial goals. That's why we've made it simple to set up secondary savings accounts - so you can save for a specific purpose. Open a Vacation club to save for that special trip! Plus, monitor your account and watch your balances grow through online banking and our mobile app!

APY: 0.05%

We want all of our members to reach their financial goals. That's why we've made it simple to set up regular savings accounts - so you can save for a specific purpose. Try a regular savings for that next big purchase in mind!

APY: 0.05%

APY: 0.80% Min Deposit: $500.00

APY: 0.80% Min Deposit: $100,000.00

APY: 2.75% Min Deposit: $100,000.00

APY: 4.50% Min Deposit: $100,000.00

APY: 4.25% Min Deposit: $100,000.00

APY: 2.75% Min Deposit: $500.00

APY: 4.25% Min Deposit: $500.00

APY: 4.00% Min Deposit: $500.00

APY: 3.75% Min Deposit: $500.00

APY: 3.51% Min Deposit: $500.00

APY: 3.55% Min Deposit: $500.00

APY: 3.55% Min Deposit: $500.00

APY: 3.55% Min Deposit: $500.00

APY: 3.75% Min Deposit: $100,000.00

APY: 3.55% Min Deposit: $500.00

APY: 3.55% Min Deposit: $500.00

APY: 3.03% Min Deposit: $500.00

APY: 3.03% Min Deposit: $500.00

APY: 3.03% Min Deposit: $500.00

APY: 3.03% Min Deposit: $500.00

APY: 3.03% Min Deposit: $500.00

Your funds will not be transferred until all of your accounts are approved

Credit Life and Credit Disability Insurance, underwritten by CMFG Life Insurance Company, is available for most loan products

Would you like more information about protecting your loan payment or balance with Credit Life and Credit Disability Insurance from your lender?Debt Protection is available with most loans by the credit union. It is designed to cancel your loan payment or balance, up to the contract maximums, if a protected life event occurs. Available package options will include one or more of the following life events: Life, Disability or involuntary unemployment.

Would you like more information about protecting your loan payment or balance with Debt Protection from your lender?MEMBER’S CHOICE™ Guaranteed Asset Protection (GAP) is an optional protection product made available by the credit union. In the event of a total loss, GAP is designed to cancel the difference between your primary insurance settlement and the outstanding loan balance, up to the contract maximums. For more information, call or visit the credit union.

Would you like more information about protecting your loan with GAP from your lender?Mechanical Repair Coverage can help you limit the cost of covered vehicle breakdowns.

Would you like more information about Mechanical Repair Coverage from your lender?Your application is not complete until you read the disclosure below and click the ''I Agree" button in order to submit your application.

You are now ready to submit your application! By clicking on "I agree", you authorize us to verify the information you submitted and may obtain your credit report. Upon your request, we will tell you if a credit report was obtained and give you the name and address of the credit reporting agency that provided the report. You warrant to us that the information you are submitting is true and correct. By submitting this application, you agree to allow us to receive the information contained in your application, as well as the status of your application.

Authentication Questions

Co-Authentication Questions

Account Information

Application Completed

Almost Done

Congratulations

Funds Pending

Almost Done

Congratulations

Funds Pending

Access Denied

You're logged in as

You're logged in as